Update notifications will be distributed via X (ENG&JPN) and LINE (JPN). Search and follow/add "@nanahoshimgmt"

Strengthen Wakamoto (4512 JP Equity)

Presented by

This website serves as a campaign platform for the shareholders of Wakamoto Pharmaceutical Co., Ltd. ('Wakamoto')

Summary of Shareholder Proposals for the AGM, June 2024

Distribute a dividend yielding 9% on equity, equivalent to the cost of equity, aiming to attain a PBR at >1x

Reverse separate reserves to facilitate a more flexible capital allocation

Disclose the types and numbers of laboratory animals purchased as part of enhancing transparency in animal welfare initiatives

Disclose Scope 3 greenhouse gas emissions from cross-shareholdings as a measure to address climate change risks

Disclose Annual Securities Reports (YUHO) ahead of the AGM to improve the decision-making process for exercising voting rights

Disclose 'Action on Cost of Capital-Conscious Management and Other Requests (TSE)' before the AGM

Recent Dialogues

On 15 April 2024, our shareholder proposals were disclosed.

Contents: Proposals for the AGM coming June

On 6 March 2024, a communication was dispatched to the Company’s Board of Directors.

On 29 January 2024, correspondence was directed to the Company.

Contents of this website

Measures we consider to improve the adjusted PBR at 0.55x.

Enhancing ESG practices to reduce the cost of capital.

Optimising capital efficiency

Our view of Wakomoto's issues & solutions

(Note: Unless specified differently on this site, the share price and market capitalisation figures represent yearly averages of JPY 221 and JPY 7.7 billion, respectively, for the period beginning 11 April 2024; financial figures are as of December 2023).

Exceptionally low valuation of the share price

As illustrated in Annexe 1, the valuation of the share price stands at merely 0.55 times (■÷■) when viewed through the adjusted price-to-book (P/B) ratio.。

It's worth noting that the price-to-book (P/B) ratio, calculated prior to adjustment, remains significantly below 1x (■÷■).

Annexe 1: Diagram illustrating the adjusted price-to-book ratio (PBR).

The adjusted price-to-book (P/B) ratio (share price divided by adjusted BVPS) is notably low.

(Not: Adjusted BVPS are determined by dividing the sum of after-tax unrealised gains on rental properties added to equity by the total number of issued shares, excluding treasury shares. After-tax unrealised gains on rental properties are calculated using the formula (market value of rental properties - book value of rental properties) x (1 - assumed tax rate of 30%)).

Pharmaceutical business has accumulated losses of >7 billion yen

As detailed in Annexe 2, the Pharmaceuticals division has experienced losses for 14 consecutive quarters since reported as a segment. Over the last 14 fiscal years, the cumulative segment loss has reached 7.3 billion yen.

As highlighted in Annexe 3, concerns were raised regarding the focus on the field of ophthalmology. It's important to acknowledge that the late Mr. Makita Shoichi, who departed from the Bank of Japan, played a pivotal role in the revival and management overhaul of Wakamoto Pharmaceutical.

However, it appears that the medical business has adopted a management policy of focusing on the ophthalmology area (Nobuyuki Kamiya, appointed president in April 2011 (Drug Magazine, June 2011 issue)) and specialising in medical products in the ophthalmology area (Yoshihiro Horio, appointed president in April 2017 (Drug Magazine, August 2017 issue)).

Rather than adhering to its management strategy of specialising in ophthalmology, the Company ought to evaluate the viability of continuing its pharmaceutical business from a capital cost viewpoint.

Evaluate the advantages and disadvantages of focusing on ophthalmology, considering the implications of the cost of capital.

Should providing a logical justification in terms of the cost of capital prove challenging, we will opt to withdraw. Subsequently, we will concentrate more on leveraging the strengths, like the expansion of the 'Strong Wakamoto' brand.

Annexe 2: Cumulative segment profit/loss for the pharmaceutical business since reported.

The cumulative segment loss is worsening at a pace akin to a market capitalisation of approximately 7.7 billion yen.

Annexe 3: Caution against over-specialisation in ophthalmology within the pharmaceutical sector.

Over two decades ago, amid a company restructuring, the president had already flagged concerns about the focus of the pharmaceutical business.

A potential explanation for the underperformance of the pharmaceutical division might be its overly concentrated efforts on ophthalmic drugs across various functions - including research, development, sales, and academia. The division's deep entanglement with ophthalmologists has left little room to explore other business avenues, positioning us more as a specialist in ophthalmic drugs rather than a diversified pharmaceutical company. While enhancing the ophthalmology division's output is commendable, broadening our pharmaceutical portfolio is crucial for the overall growth of our company. I had a conversation on this matter years ago with our advisor, Dr Kasuya, who concurred with my observations. Consequently, I encouraged him to identify an outstanding researcher to spearhead diversification in our product development. This transformation necessitates a fortified focus on research and development, a critical element for our reform.

Cited from 'Wakamono-Rebuilding 50 Years in Retrospect' by Makita Shoichi, 14 March 2002.

The proposal to appoint President Igarashi as a director was met with opposition from over 80% of institutional investors.

As detailed in Annexes 4 and 5, institutional investors opposed the proposal for appointing President Igarashi, raising concerns about performance criteria, capital efficiency, and the Board of Directors' makeup, notably the minimal presence of outside directors.

Regarding capital efficiency, as indicated in Annexe 6, the company engages in property leasing activities unrelated to its primary business, with an after-tax market value yield of approximately 1%. From a cost of capital perspective, maintaining rental real estate with such a minimal yield is not justifiable.

The estimated return on equity (ROE), calculated using adjusted equity capital of around JPY 14 billion as of December 2023, factoring in a tax rate of 30% and after-tax unrealised profits from rental properties, stands at about 5%. This figure falls below the cost of capital.

Recognise that the circumstance is exceptional, given that 84% of institutional investors are opposed to the appointment of President Igarashi.

Address the reasons behind institutional investors' opposition, including poor performance, low capital efficiency, policy shareholdings, and a low percentage of independent non-executive directors.

Conveying rental real estate assets at a fair price.

The company does not retain assets that are unnecessary for its primary operations (non-operational assets). When viewed from a capital cost standpoint, the capital efficiency of rental properties is not at a level that warrants affirmation.

Formulate a medium-term strategy aimed at enhancing shareholder value.

Fulfilling the existing medium-term management plan will not augment shareholder value. The medium-term management plan ought to be swiftly revised to reflect a cost of capital perspective and additionally to incorporate the reasons behind institutional investors' opposition into management considerations.

Annexe 4: Outcomes of institutional investors' votes on the appointment of President Igarashi.

16 out of 19 voted against the proposal for the appointment of the President at the AGM held in June 2023.

Name

Voting

reason

1

Opposition

Because the number and ratio of external directors do not meet the Company's criteria

8

〃

Against because the independence criteria (more than 1/3) of the Board of Directors is not met

10

〃

Against the appointment of all candidates because of the inappropriate composition of the independent non-executive directors; against the reappointment of directors who have been in office continuously during the relevant period because the return on equity has been below a certain level for three consecutive terms;

12

〃

Unable to endorse the ongoing selection of directors amid persistent underperformance; demands the appointment of a minimum of one-third independent non-executive directors.

15

Mizuho Trust

〃

Criteria on performance

16

Dimensional Fund Advisors

〃

-

(Note: compiled by Nanahoshi Management from company websites with reference to Prof. Tsuburaya's laboratory website ; AM stands for Asset Management).

Annexe 5: Board of directors.

The percentage of outside directors is less than 30%.

1

Representative director

Arata Igarashi

2

Director

Kimihiko Sato

3

Director

Akihiko Tanigaki

4

Director

Hiroyoshi Kasai

5

Director

(Member of the Supervisory Committee)

Haruhisa Hirata

6

Independent Outside Director

(Member of the Supervisory Committee)

Katsuyoshi Ejima

7

Independent Outside Director

(Member of the Supervisory Committee)

Ikuro Kuwahara

Annexe 6: After-tax market value yields of rental properties.

The market value of rental property amounts to half of its market capital.

(Note: The after-tax market value yield is determined by dividing the rental profit or loss adjusted by (1 - the expected tax rate of 30%), as mentioned in the notes to the annual report, by the average balance of the market value of rental properties over the period)

Approaches to managing climate change risks in relation to cross-shareholdings.

As highlighted in Annexe 7, there's a growing emphasis on addressing climate change risks associated with cross-shareholdings. Initially, a company's possession of cross-shareholdings is viewed as an investment in the issuer of those shares. Consequently, we posit that the climate change risks encountered by issuers of cross-shareholdings should be acknowledged to the same extent as those risks faced by, for example, a company's own manufacturing facilities. Thus, it's the belief that companies ought to disclose the climate change risks of issuers of cross-shareholdings as part of their own climate change risk profiles.

Nevertheless, we stand against cross-shareholdings, whether disclosed or not. There are several issues with business relationships founded on strategic shareholdings. For instance, they can hinder a healthy competitive landscape and become hotbeds for fraudulent activities. Additionally, an increase in the number of stable shareholders may weaken management discipline.

Nonetheless, as indicated in Appendix 8, the company has pledged just under 80% of its cross-shareholdings as collateral to banks. The act of pledging cross-shareholdings as collateral clearly signals that the company has no plans to sell at least those shareholdings used as collateral. This move by the company should be seen as contravening the spirit of the Corporate Governance Code, which aims to reduce cross-shareholdings.

Sell cross-shareholdings swiftly.

Cross shareholdings should be avoided not just from the social and governance (S and G) aspects of ESG, but also from the environmental (E) standpoint, including responses to climate change risks. Accordingly, cross-shareholdings that have been pledged as collateral to banks should be promptly discharged or sold.

If cross-shareholdings are retained, disclose the share of greenhouse gas emissions attributed to those shareholdings.

In the annual report, detail the equity of greenhouse gas emissions and outline the reduction policy in connection to the 'Strategy' and 'Metricss and Targets' outlined by the TCFD.

Annexe 7: Perspectives on the Climate Change Risk of Policy Shares

Cross-shareholdings must also be considered in the context of responding to climate change risk.

As the cost of greenhouse gases becomes acknowledged, firms with significant policy holdings at risk of becoming stranded assets should be urged to offer more transparent explanations.

(Kazuhiro Toyoda, Schroder Investment Management)

Japanese firms are equally obliged to reveal the climate change risks associated with their policy holdings.

(Tomohiro Ikawa, Fidelity Investment Trust)

Cited in the Nikkei Newspaper Morning Edition, 19 October 2023, page 19, under 'Environmental Risks in Stocks with Policy Holdings'.

Annexe 8: Summary from Page 55 of the Company's 128th Annual Report

Although the company is essentially free of debt, it has secured JPY 1.898 billion, representing 76% of its total policy shareholdings valued at JPY 2.483 billion, with banks as collateral for a JPY 900 million credit line. This line may or may not be utilized in the future (as of the end of March 2023).

(Notes to the Financial Statements)

Securities Pledged as Collateral

Starting this fiscal year, the company has entered into an overdraft agreement of 900,000 thousand yen with a bank, where it has an overdraft facility, which has been pledged as collateral. By the end of this fiscal year, no borrowings have been made under this overdraft agreement.

| 31.3.2022 | 31.3.2023 | |

| Securities | 1,624,657 thousand | 1,898,817 thousand |

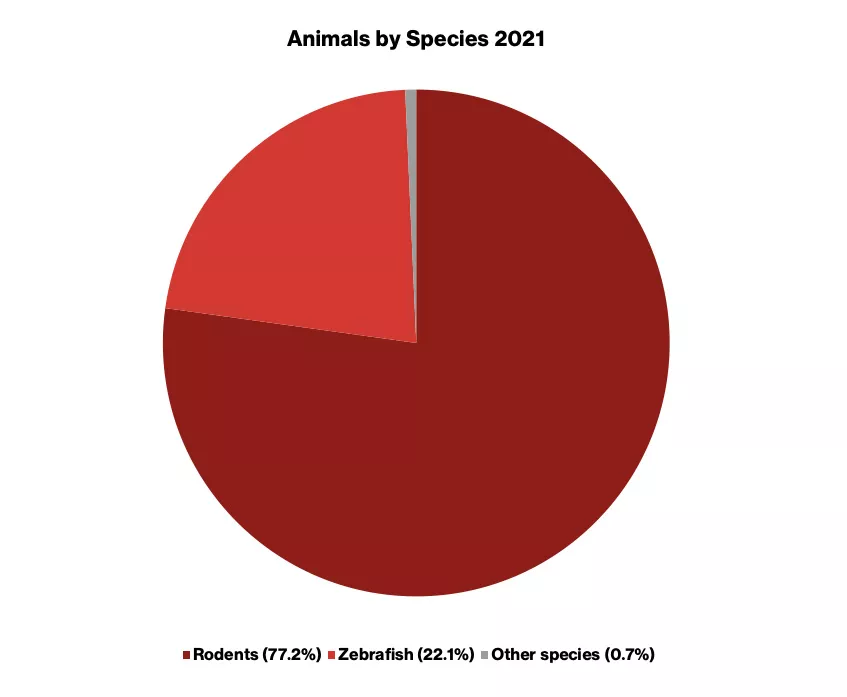

Disclosure on animal welfare

In the pharmaceutical industry, animal testing is conducted globally in adherence to the 3Rs (*) to verify efficacy and safety data.

*Reduction in the number of animals used, minimization of suffering (Refinement), and adoption of alternative methods (Replacement).

As detailed in Annexes 9 and 10, in their commitment to the 3Rs, pharmaceutical companies worldwide have released numerical data on the quantity of laboratory animals purchased by species, for instance, aiming at the reduction of the number of animals used in experiments (Reduction).

In connection with this, the company discusses its adherence to the 3Rs, conducts monthly visits to the animal memorial, and discloses that it is consistently accredited by the General Pharmaceutical Information Centre of Japan for following the Guidelines on Animal Experiments, among others, as mandated by the Ministry of Health, Labour and Welfare (Notification of 1 June 2006).

Nevertheless, we contend that in order to verify adherence to the 3Rs, disclosure should encompass not just the qualitative information mentioned above, but quantitative data as well.

Reveal the quantity of laboratory animals acquired, broken down by species.

Annexe 9: Instances of discussions regarding the number of laboratory animals acquired by animal

Worldwide pharmaceutical corporations reveal the quantity of laboratory animals they procure for research purposes.

(Source: Bayer)

(Source: Novartis website, Rodents: 353,772, Zebrafish: 88,229 and Other: 432)

Annexe 10: Quantity of laboratory animals acquired by species (instances of comprehensive disclosure)

Novo Nordisk provides in-depth disclosures specific to each animal type.

(Source: Novo Nordisk)

Board of directors, of which just under 30% hail from the principal bank

As detailed in Annexes 11 and 12, slightly less than 30% of the Company's Board of Directors are representatives from its principal bank, Mizuho Financial Group ("MHFG"), with the majority of the Board consisting of individuals from MHFG.

While MHFG, as a significant shareholder owning about 3% of the company's shares, dispatching directors is not inherently problematic, the reality that an individual from a shareholder with merely a 3% stake persistently fills less than 30% of the board seats exceeds the customary practice of nominating directors by a major shareholder. This scenario suggests a lineage of control stemming from the main bank.

The company will not accept any more directors from the main bank in the future.

The structure of the voluntary Nomination and Remuneration Committee is such that two out of three members hail from MHFG. It is precisely due to this makeup, which could give rise to suspicions of "amakudari" (descent from heaven), that a decision should be made against accepting any future instances of "amakudari."

Annexe 11: Profile of directors from MHFG in recent years

Internal directors of the board join the company as directors and then become directors of the board.

Mr. Arata Igarashi (current President and Representative Director)

Apr 1981 Joined Industrial Bank of Japan (now Mizuho FG)

Apr 2005 General Manager, Sales Division 14, Mizuho Corporate Bank, Ltd.

May 2010 Joined the Company (Director)

Jul 10 General Manager, General Affairs & Public Relations Dept.

Apr 2011 General Manager of Corporate Planning Office and General Manager of General Affairs Department

June 2011 Director

Jun. 2012 Managing director

Jun 19 Senior Managing Director

Apr 2022 President and Representative Director (to present)

Mr. Katsuyoshi Ejiima (slid from external auditor to current director)

Apr 1977 Joined Dai-Ichi Kangyo Bank (now Mizuho FG)

Mar 2006 Managing Executive Officer, Mizuho Corporate Bank, Ltd.

Apr 2008 Managing Executive Officer, Mizuho Bank, Ltd.

Jun 202009 President and Director, Mizuho Investors Securities Co.

Jan 2013 Executive Vice President and Executive Vice President of Mizuho Securities Co.

Apr 2014 Standing Advisor of Mizuho Securities Co.

Jun 2016 Outside auditor of the Company

Jun 2017 Independent Outside Director (Member of the Supervisory Committee) of the Company (currently in his seventh year)

Mr. Hideo Sugamata, former managing director

Jul 1971 Joined Industrial Bank of Japan (now Mizuho FG)

Jun 1996 Branch Manager of Hibiya Branch of the same bank

Feb 1999 Joined the Company (Director)

June 1999 Director

Jun 2002 Managing Director

Jun 2007 Senior Managing Director

Jun 2015 Resigned

(Note: prepared by Nanahoshi Management from the annual report.)

Annexe 12: Representation of MHFG Members on the Board of Directors

For the seventh year running, over 25% of the Board of Directors consist of individuals from MHFG.

| # of directors | percentage | A | K | H | |

| Jun23 | 7 | 28.6% | 〇 | 〇 | |

| Jun22 | 7 | 28.6% | 〇 | 〇 | |

| Jun21 | 7 | 28.6% | 〇 | 〇 | |

| Jun20 | 7 | 28.6% | 〇 | 〇 | |

| Jun19 | 7 | 28.6% | 〇 | 〇 | |

| Jun18 | 8 | 25% | 〇 | 〇 | |

| Jun17 | 7 | 28.6% | 〇 | 〇 | |

| Jun16 | 13 | 15.4% | 〇 | 〇 | |

| Jun15 | 13 | 7.7% | 〇 | ||

| Jun14 | 11 | 18.2% | 〇 | 〇 |

(Note: This is compiled from the company's annual report by us).

The truth about the resignation of the former Chairman and President (and former Chief Advisor to the Board of Directors)

As indicated in Annexe 13, Mr. Nobuyuki Kamiya ("Mr. Kamiya"), the former Chairman and President of the Board of Directors of the Company, was planned to transition from Director and Chief Advisor to solely Chief Advisor in late June 2022. However, he unexpectedly resigned in mid-June of the same year.

Articles suggest that Mr. Kamiya's resignation was prompted by personal misappropriation.

As detailed in Annexe 14, Mr. Kamiya served as the representative director of the Company for over 10 years and also held the position of chief advisor to the board of directors. As shareholders, we cannot ignore the sudden resignation of someone so closely associated with the company, especially when the company cited 'personal reasons' for his departure amidst reports of personal misappropriation. We urge the Company to implement the following measures:

Release the investigation report and clarify the nature of the problem.

Should the investigation report remain undisclosed and no third-party investigation has been carried out, then a third-party committee should be established to conduct a new investigation.

Rebuild market trust by clarifying responsibilities.

Initiate disciplinary measures, including claims for damages, against all involved parties. Develop and enact strategies to prevent recurrence.

Annexe 13: Disclosures and Articles on Private Misuse

The company stated that Mr. Kamiya's departure was due to personal reasons.

Announcement of changes in directors (including changes in representative directors)

RE: Mr Kamiya

- Former position: director and chief adviser → New position: chief adviser (planned for late June 2022)

Notice of resignation of director.

RE: Mr Kamiya

- Former position: director and chief adviser → New position: none

- Reason for resignation: personal reasons

(Note: compiled by Nanahoshi Management from the website and the Daily Yakugyo website.)

Annexe 14: Mr. Kamiya's Biography

His roles have included president, chairman, and chief adviser.

Apr 1968: Joined Kowa Shinyaku Co.

Jun 2004: Became a Director at Kowa Co.

Apr 2006: Appointed as Director at Kowa Shinyaku Co.

Jul 2007: Elevated to Managing Director at Kowa Co.

Jan 2010: Joined Wakamoto as a Director

Jun 2010: Took on the roles of Vice Chairman and Representative Director

Apr 2011: Became President and Representative Director

Jun 2004: Served as Representative Director, Chairman, and President

Apr 2017: Appointed as Chairman of the Board and Representative Director

Apr 2009: Assumed the position of Chairman of the Board

Jun 2009: Became Director and Chief Adviser

Jun 2010: Stepped down

(Note: compiled by Nanahoshi Management from the company's annual report).

Separate reserve funds left to build up

As detailed in Annexe 15, the company's Board of Directors has chosen not to distribute dividends for 7 of the past 15 fiscal years. Despite this, the company's balance sheet lists a separate reserve totalling 3.953 billion yen. This separate reserve could serve as a dividend source by being transferred to retained earnings carried forward. Calculating the separate reserve of 3.953 billion yen divided by the total number of shares outstanding (0.347 billion shares), excluding treasury shares, results in 114 yen per share.

The net proceeds from selling leasehold property and policy shares(■), as detailed on the balance sheet and after deducting assumed tax payments(■), plus cash on hand(■), minus interest-bearing debt (■)(referred to as 'net cash equivalents(■)' in Annexe 16), are substantial. We advocate for the Company to utilize the surplus cash, exceeding the proceeds from the sale of non-operational assets and working capital, for investments and shareholder returns to boost the Company's shareholders' value.

Initially, it's important to note that there isn't a specific regulation stipulating that dividends must solely be distributed from the profits of a particular financial year. Viewing it as a strategy to assure shareholders a consistent return despite performance variability, employing the Dividend on Equity (DOE), which reflects the cost of equity, as the policy for shareholder returns proves to be beneficial. Moreover, given Wakamoto's substantial equity ratio of 76.7%, we anticipate that adopting such a capital policy will optimise the equity capital level. Consequently, we propose that the Company undertakes the following measures.

Complete reversal of the entire separate reserve fund.

Adopting a 9% Dividend on Equity (DOE) as the shareholder return policy.

Should the Dividend on Equity (DOE) be set higher than the cost of shareholder equity, with a DOE target of 9% as part of the shareholder return strategy, shareholders can look forward to stable and appealing returns. This approach diminishes the risk associated with investing in the company. It's worth mentioning that we've determined the cost of equity to be around 9%(*).

*Utilizing data from *Data 1 and the equity spread method, we've calculated the cost of equity. This involves dividing the Return on Equity (ROE) by the Price to Book Ratio (PBR), under the assumption of no profit growth. We've estimated the ROE by dividing this year's net profit—which is derived from subtracting a presumed 30% tax rate from the ordinary profit goal of JPY 1 billion in the last year of the five-year medium-term management plan starting in FY2021—by an adjusted equity capital of JPY 14 billion. This adjustment considers the post-tax unrealized profit on rental properties, resulting in an ROE of about 5%, and an adjusted PBR of 0.55x. Thus, the cost of equity is roughly calculated to be 9%.

Annexe 15: Dividends per share over the past 15 years

In 7 of the 15 financial years, the company has not paid a dividend.

Annexe 16: The acmout of net cash equivalents.

The revenue generated from selling non-core assets reached JPY5 bn, in contrast to a market capitalisation of 7.7 bn.

Wakamoto Pharmaceutical Business Partners' Shareholding Association

The third largest shareholder in the company is the Wakamoto Pharmaceutical Business Partners' Shareholding Association. Yet, the presence of this Shareholding Association contradicts the objectives of the Corporate Governance Code, which advocates for minimizing policy shareholdings. The reason being, shares in publicly traded companies, when involved with business partners' shareholding associations, are often acquired as policy shares.

As indicated in Annexe 17, companies listed as part of business partners' shareholding associations mention "acquisition of shares through business partners' shareholding associations" in the "Purpose of holding the shares" section within their annual reports.

The Japan Securities Dealers Association's guidelines on shareholding schemes articulate that the aim of a business partners' shareholding association is "to foster amicable relations through the acquisition of shares by individuals connected with the business." However, it's undeniable that a significant motive behind this is to secure stable shareholders. Indeed, a publication by a leading securities firm outlines that one of the benefits of establishing a business partners' shareholding association is its potential to act as a stable shareholder. We anticipate the Company to undertake the following actions:

Disband the business partners' shareholding association. Alternatively, approach the chairing company that oversees the association to request its dissolution.

Annexe 17: Illustration of financial statements from a company within the Business Partners' Shareholding Association of the Company.

An uptick in stable shareholders might result in a decrease in management discipline within the company.

The objective behind holding these shares is to cultivate robust and enduring trust-based relationships with business partners, which are fundamental to the company's market value. The Company engages in transactions not only in pharmaceutical packaging, including the necessary documents and labels, but also in packaging machinery. The rationale for maintaining these shareholdings lies in both facilitating ongoing business dealings and securing an economic justification for the investment in shares. Furthermore, the shareholding has expanded through acquisitions made by the business partners' shareholdeing association.

Source: Justification for holding shares in Asahi Printing Corporation as outlined in its 107th Annual Securities Report, page 55 [Shareholdings].

The necessity of re-evaluating the objectives of the company and the reason for listing on the stock exchange

The duty of directors in a joint stock company is to enrich the shareholders who possess the power to elect them, through increases in share price and dividends. It's expected that Wakamoto's directors adopt a management approach aimed at enhancing shareholder value. Should this prove unfeasible, considering the transition to a private company remains a viable pathway.

Directors should not view transitioning to a private entity negatively. Nonetheless, the exploration of de-listing does not imply a cessation in the pursuit of shareholder interests. Prior to moving towards de-listing, we aspire for the company to attain a shareholder value exceeding an adjusted Price to Book Ratio (PBR) of 1x, encapsulating the latent profits from rental properties fully.

If it becomes challenging to foster management policies that elevate shareholders' value or to contemplate de-listing after striving to enhance shareholder value, we urge the invitation of a director dedicated to the advancement of shareholder value and prompt the resignation of the current directors from their roles.

Annexe 18: The total shareholder return since Mr Kamiya's resignation (after 17 June 2022)

Share prices have notably lagged both in absolute terms and relative to the index.

(Note: Total shareholder yield is a measure of stock price performance that excludes the impact of dividends paid out. The TOPIX, when including dividends, is calculated on a post-tax basis, and similarly, Wakamoto's dividends are recalculated and compared after taxes have been taken into account.)

If the directors fail to implement a management policy aimed at enhancing shareholder value, we will proceed to delist and exit the stock market.

Should they opt not to delist, they must resign from their directorial positions, paving the way for new directors who are committed to increasing shareholder value.

Copyright © Nanahoshi Management Ltd. All Rights Reserved.